The following is drawn from a lecture given at the Cooper Union for the Advancement of Science and Art in New York City earlier this year. Written before the current election, it addresses in part the winner, whoever he may be.

Americans have long been eager consumers and home owners. But there is no doubt we collectively overdid it during the years leading up to the financial and economic crisis of 2008. The personal savings rate dropped close to zero. Mortgage indebtedness grew to new (and ultimately unsustainable) heights.

All that occurred as real income for average American households rose little if at all. That’s not supposed to happen in a growing, productive economy. High consumption maintained at the expense of saving and increasing indebtedness simply could not be sustained in the face of the stalled income of the “99 percent.”

At the beginning of this century, we actually had a balanced federal budget. Then the failure to match higher defense and mandated health care expenditures with revenues not only inexorably eliminated the surplus but led to the largest peacetime deficits in history even before the recession. With little or no private savings, by mid-decade we were relying on borrowing from abroad to finance both public and private expenditures. China, Japan, and other emerging nations were perfectly happy to supply our consumers with the goods they wanted and to take dollars in payment. They kept it up, even as dollar interest rates descended toward zero.

Our dependence on external financing reached levels of $500–600 billion a year, 5 percent or more of our GDP, which was well beyond any historical patterns. Happily, as a nation, and as a government, we have been able to continue to borrow abroad right through the recession. But can we count on doing that indefinitely?

Of course not.

We look upon ourselves, with some justice, as a great country, the strongest and richest in a changing and troubled world, a place of stability and leadership. But now our country is mired in debt. It is dependent on large continuing flows of capital from abroad, without much savings of its own and with slow growth and household income flat. Those are not characteristics of a country willing and able to prolong its global leadership.

We need to rebalance the economy—to achieve more productive domestic investment and more personal savings—and to turn around the enormous federal deficits. That’s all the more difficult with high unemployment and dependence on stimulus programs.

Here and there, a few hopeful signs emerge, including some spending cuts. But as with financial reform, the effort is incomplete. In fact, it has barely started. And the whole world knows it.

That is all background. My point here is that we should look ahead. Where is the solid ground upon which to build, to restore some clear sense of national interest and national purpose, to restore confidence in the political process and in government itself?

We don’t simply have a financial problem, a problem of economic balance and structure: we have a more fundamental problem of effective governance.

Virtually every day we read of polls about the president’s popularity, or the ups and downs of the Republican contenders during the recent election. The poll that concerns me is different, and much more challenging.

“Do you trust your government to do the right thing most of the time?” That question has been asked regularly for decades by experienced pollsters. These days only 20 percent or even less say yes. In other words, four out of five Americans don’t instinctively trust our own government to do the “right thing” even half of the time. That’s not a platform upon which a great democracy can be sustained.

I know we have been witnessing a large ideological debate. Much of that is beyond the concerns of financial or economic policy. But I also know that the political divide is too often put as “big government” versus “small government.” That particular argument may be—probably should be—endless. After all, it started back at the beginning of the republic, Jefferson against Hamilton, on and on. But can we not agree on some basic points of departure?

Government is, after all, necessary. What we want is effective government, worthy of instinctive trust. I have long been concerned that our particular governments—large or small, federal, state, and local—are not consistently administered and managed as well as they should be, and can be.

I have spent most of my adult life in and around public service. I know there are government agencies that are well managed, responsive to their vital public responsibilities, and effective. We all know some that have not been: think back to New Orleans and Katrina or more recently to the Gulf oil spill. Then, federal agencies with the specific responsibility of anticipating and dealing with such emergencies were effectively AWOL. Happily that was not true in the case of the recent Hurricane Sandy. But there have been continuing failures in local planning and preparations for such large hurricanes. At the other end of the spectrum, we have some huge bureaucracies—the enormous defense establishment for one—that both amaze and reassure us in time of need but also have too many pockets of weak performance and even corruption.

Advertisement

To my mind, our universities with prestigious schools of “Public Affairs” and “Public Policy” have concentrated far too much on high-level policy debates—i.e., what should be done—and far too little on what in practice can be done. Grand policy and great strategy can’t count for much without the resources and skills needed for implementation and management.

I also sense that it is the instances of ineffective administration—high costs, absence of clear goals and measurement of results, poor incentives—that contribute to the lack of trust that is so evident and now so deep-seated.

Concerned as I may be about those old-fashioned ideas of good and effective administration, the big challenge today is more immediate and critical. Can we find some intellectual and political base for concerted action on the unfinished economic and financial issues that I touched on earlier?

Without a positive answer to that question any new administration and any new Congress, red, blue, or a mixture, will be in trouble. And that trouble won’t be confined to Washington, D.C.

It is questions of budget policy—spending and taxation—that bring the abstract concern to the realm of decision-making. Hard as it is to contemplate, federal revenue today covers little more than 60 percent of expenditures. That’s something that historically has happened only during a big war, never in relative peace, or even in limited wars. Spending has climbed well above past levels—at one point rising from the previous 20 percent or so of GDP to around 25 percent. In the midst of recession, revenues fell to 15 percent of GDP. Even with economic recovery, the remaining deficits will be far larger than we can finance from our own savings.

Experience strongly suggests that the present system of personal and corporate income taxes—shot full of special credits, exemptions, loopholes, and evasion—has reached practical limits. We have come to rely on payroll taxes to finance mandated expenditures, and they too may be approaching economic and political limits.

That’s all widely known and understood. We have had commissions, official and unofficial, to assess the outlook with broadly consistent conclusions. Their reports confirm that it will take very strong measures—encompassing savings in entitlements, and in defense as well as civilian expenditures—to get spending as low as 21 percent of GDP. Given the demands of an aging population and rising health care costs, it will take years to attain that level and even more effort to sustain it.

On the revenue side, there isn’t much to support confidence that a creaking and contentious revenue system heavily dependent on income taxation can maintain its contribution to revenues, much less support a significant increase. So even if expenditures could be reduced to 21 percent (as the official National Commission on Fiscal Responsibility and Reform thought eventually possible by 2035!), some significant revenue increase will be necessary to eliminate the deficit.

The implication is obvious. Large changes in budgetary policy are necessary. They need to be structural. They need debating. And as a practical matter, the budget commitments needed will have to extend over years—years far beyond a single presidential term.

So what do we have on which to build? I would suggest that for all the positioning on the political landscape, there is a core of common understanding that should provide a base for constructive negotiation. Importantly:

Over time we do need to cut spending by some hundreds of billions of dollars a year (and a part of that could and should be achieved by administrative reforms).

We do need to undertake tax reform, personal and corporate, in ways that can both generate some added revenues and bear more heavily on consumption than investment.

We do need to consider how federal policies can support critically needed infrastructure and also review responsibilities for Medicaid, both of which involve states. Many of these are already so hard pressed that they cannot come close to meeting existing commitments.

We do need to consider how tax and spending decisions bear upon the desire for energy independence, the threat of global warming, and the environment.

And of course, we do need to review the two big entitlement programs, Social Security and Medicare, in the light of their looming deficits down the road and the unbending demographic pressures.

Impossible to do? The question should rather be, can we do without?

Advertisement

Better to set out a large framework than start by accepting inadequate bits and pieces. Most important, Americans must come to understand what is at stake.

Perhaps I am unrealistic in my search for common ground among the competing political interests. However, the urgent need for convincing action on the economic and fiscal front doesn’t permit an end to the search.

In that effort, let me suggest a simple test for the willingness of the two parties to work together in an important procedural area without compromising their ideological, social, and political differences.

It is widely known that the constitutional process for nominating and confirming the federal government’s senior policy officials has become dangerously distorted, inhibiting the prompt and effective leadership and management of any new administration. The nominating process for the five hundred or so presidential appointees subject to confirmation has become an obstacle course, with interminable duplicative “vetting” of the financial, business, and personal lives of potential appointees by new administrations and Congress alike. Then a potential nominee may be left hanging for months, in some instances for a year or more, awaiting senatorial “consent” to a presidential nomination.

The delays and risks for an able and well-respected man or woman willing to take up the gauntlet of public service are daunting. These days too many of the highly competent and willing, even those eager to make a contribution, simply refuse to be considered or to wait out the process. The consequence is that a new or reelected president is left without key members of his team in place for many months, sometimes for a year or more. He is crippled in developing, defending, and administering his policies.

Through the years, and again now, a number of commissions and experienced executives have proposed approaches to speed the process. Among them are actions to reduce overlapping vetting procedures, and more importantly to cut back the number of offices that require Senate confirmation.

Yet over time, the appointment process has deteriorated even as the needs have become more pressing. Large obstacles remain to providing for the basic needs of any newly elected president, his party, and not least the country.

Rethinking is in order.

Can we, for instance, build on the simple fact that there will be an interval before the elected president takes office? It is in the interest of both the winning candidate and his party colleagues in the Senate to seek a “mutual disarmament pact” with respect to new executive branch appointees.

Specifically, suppose the winning candidate and the party leaders in the Senate were to “hold hands” and join in a limited but important agreement that would include:

Establishing a common set of vetting requirements and investigations of possible appointees.

Assurance that the relevant Senate committee will act in no more than, say, four weeks from the time of a presidential nomination, and that a committee-approved nominee would promptly be sent to the full Senate.

A commitment that the Senate in turn will vote on the nominee, up or down, by majority rule within, say, another four weeks.

A further commitment that so-called “holds” by individual senators for purposes not directly related to the nominees’ personal qualification would not be honored beyond, say, eight weeks after the president sends his nomination to the Senate.

Dependent upon such agreement, recess appointments would be logically limited to the rare circumstance of a compelling need during an extended recess.

Such an approach would require a change in Senate rules. No doubt, some members of that exclusive club will be reluctant to concede an existing privilege. But surely solemn pledges by the presidential contenders and the majority and minority leaders of the Senate acting together in the public interest should carry heavy weight, and establish a precedent for elections ahead.

After all, the problem is evident. Delay and obstruction have taken on the element of tit for tat—with one frustrated party after an election induced to repeat and even outdo such practices after the next election.

Too much is at stake for that purely partisan political posturing. Over time, it favors neither one side nor the other. It does not compromise any substantive party position. Would not a bit of comity and senatorial courtesy with respect to confirmation procedures for any newly elected president make sense? In the end, that is a matter the Senate itself will need to consider and decide, but surely the time for a clear decision is now.

Meanwhile, the severely compromised appointment process is only a part of the increasingly bitter partisanship that seems to be poisoning our political life. But isn’t it also time to step back and build upon the important elements of common ground?

Our economic and political problems, if unresolved, also present a grave threat. It is not only our economic prosperity that is in jeopardy but our national security and our ability to play a constructive role in a changing world.

I have every confidence that our financial future can be secured, and our budgetary problems can be resolved. It is also self-evident those goals cannot be reached without a common commitment to build on areas of agreement. How else can we purport to be a model of an open democratic society, not only for our own citizens but for those nations seeking their own freedom?

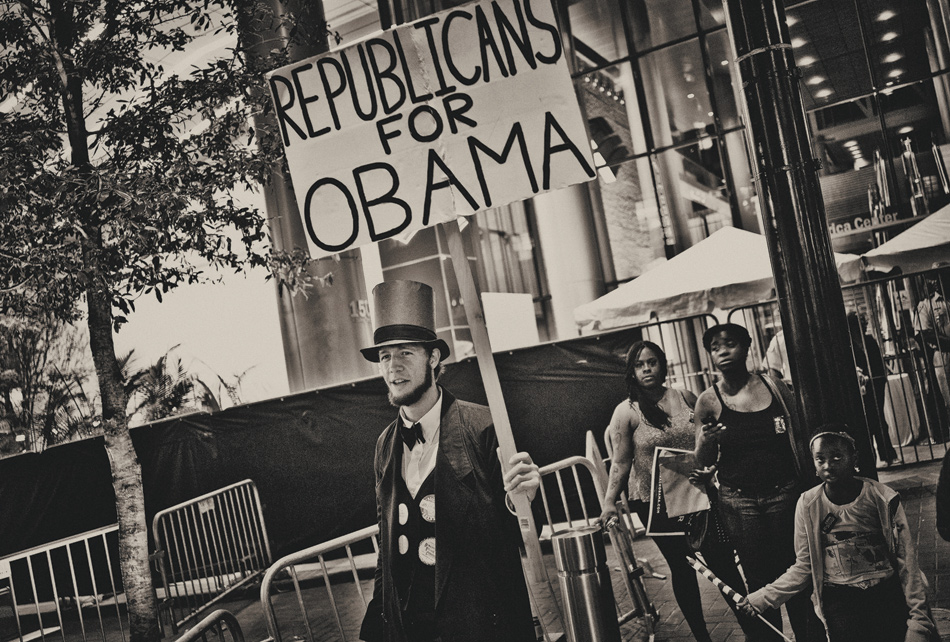

Lincoln concluded his address at the Cooper Union in 1860 with stirring words: “Right makes might.”

What’s “right” today is to find a practical consensus on how to achieve lasting financial and fiscal reform. That is the path—the only path—to restore for all to see our economic “might.” Only then, in good conscience can we fairly contest all the other social, political, and ideological issues that today preoccupy so much of our political life.

This Issue

December 6, 2012