In response to:

Can We Afford Sliced Eggplant? from the April 5, 1973 issue

To the Editors:

Jason Epstein’s review of our book, The Retreat from Riches [NYR, April 5], raises economic and political arguments to which we would like to respond.

We argued that a halt to economic growth was not necessary to curb pollution and protect the environment; rather, the job could be done directly through such devices as “pollution taxes,” which would encourage manufacturers to use low-pollution technology and induce consumers to switch to products which impose relatively minor stresses on the environment. Mr. Epstein, as we read him poses four objections:

1) Pollution taxes would reduce profits, and thus curb capital investment and growth. But Mr. Epstein’s analysis considerably exaggerates the effect that pollution taxes would have on profits, even in industries (such as the example he cites, publishing) whose processes of production entail above-average amounts of pollution. Pollution taxes or capital expenditures for clean-up devices do not, as Mr. Epstein suggests, amount to “a charge against pre-tax profit.” They are simply a cost, like any other. A business would be charged per unit of pollutant, just as it must pay per unit of raw materials. In a highly competitive industry virtually all of that cost will be passed on to consumers. In a monopolistic industry, some fraction of the cost will be absorbed through a reduction of monopoly profits. In neither case is there any mechanism which would translate a 1.5 percent cost increase or capital expenditure into a 15 percent increase in prices.

In any event, decreased profits in some sectors of the economy need not have any effect on the over-all growth rate. Policy measures such as the investment tax credit are easily available (too easily, at times) to increase profits elsewhere.

2) Pollution taxes would raise product prices, and thus force “complex adjustments” on business. Agreed, but this is nothing unique to pollution taxes. Charging for any resource that was once given away free will have the same effect. For example, Congress and the Postal Service recently raised second-class mailing rates and eliminated the subsidy for the publishing business. Higher mailing costs have been reflected in higher subscription prices and in the accelerated demise of mass circulation magazines. If this is undesirable (and we think it is) it is because one thinks that magazines ought to be subsidized, and that cheap mailing privileges represent a relatively efficient, nonpolitical means. The same could not be said, in our view, of subsidizing the publishing business by not charging paper plants for the mess they create. The “free pollution” subsidy goes not just to magazine publishers but to the people who make and use paper bags, cardboard boxes, toilet tissue, candy wrappers, etc. The subsidy is paid for by making waters unusable. Eliminating this subsidy does require complex adjustments but they are ones long overdue.

3) Pollution taxes would throw people out of work. This is an argument available against any kind of change (see Robert Adams’s article on “Saving Venice” in the same issue of NYR). Often it is valid. Just as would-be fishermen and swimmers now pay the cost of pollution that publishers get for free, so would typesetters and free-lance photographers pay part of the cost of a shift to anti-pollution policies (whether through an effluent tax or any other means). These transitional costs are often burdensome and unfair, and they suggest the need for vastly improved unemployment insurance, more aggressive fiscal policy, and at times a more cautious pace of reversal of public policies. None of this has any special force as an argument against pollution taxes.

4) Mr. Epstein quite justifiably objects to the unclarity of our estimates of the cost of pollution control. When we said that the clean-up would require less than 10 percent of GNP we were referring to the one-time capital cost. Our estimate of an annual cost of 1.5 percent of GNP (including carrying cost of capital) was taken from the 1971 Council on Environmental Quality Report (p. 122, a footnote we carelessly omitted in our book). Of course all of these figures hinge on what one means by “clean”; turning every stream into laboratory-pure water would cost a good deal more than the estimates given.

Mr. Epstein also raises two objections to our argument that the balance of payments oughtn’t to be regarded as desperately important to the American economy. Increased prices for foreign goods, he suggests, can exaggerate American inflation. That’s true sometimes but is usually not significant compared to domestic sources of inflation. Foreign trade represents about 5 percent of the total American economy. It has effects on the other 95 percent, but of course any 5 percent sector has important interactions with the remainder. So far as inflation is concerned, there is nothing distinctively significant about the goods that happen to be involved in trade.

Finally, Mr. Epstein quotes from Professor Charles Kindleberger an argument for the political significance of the balance of payments. We may possibly be experiencing, according to Professor Kindleberger, “a slowing down of American economic vitality and élan—a climacteric in the life of the economy, and perhaps society, such as Britain experienced in the last quarter of the nineteenth century when it was overtaken by Germany and the United States as we are now being overtaken by Japan.”

This seems to us Spenglerian nonsense, useful in understanding the thinking of Richard Nixon, but unworthy as a serious argument for national policy. We feel much more sympathetic to a suggestion reputedly made by Professor Kindleberger at a conference, that the intractable problem of defining the balance of payments statistics might best be resolved by creasing to keep them.

Peter Passell

Leonard Ross

New York City

Jason Epstein replies:

We don’t disagree, except perhaps about definitions. “A cost like any other” is a charge against pre-tax profits. Its effect is to reduce profits, or increase prices, etc. I didn’t say that a 1.5 percent charge for pollution control would increase prices by 15 percent (though in the paper industry something like this seems to have happened), but that such a cost would reduce profits by 15 percent, assuming a return on sales of 10 percent. Whether costs related to pollution control will reduce growth or not is anyone’s guess. My guess is that they will, and my observation is that they already have, to some extent; but growth is inhibited by so many factors these days that it’s hard to distinguish among them.

I can’t believe that higher prices for imported oil won’t seriously increase the price of heat, light, and transportation for domestic users or that increased foreign purchases of American farm products with devalued dollars won’t continue to keep domestic food prices high. The real problem seems to be that Americans are going to have to compete with more prosperous, less profligate countries for scarce resources. If the Common Market or the Japanese can outbid us for our own farm products we will have to get used to doing with less. This doesn’t seem Spenglerian to me; just a fact of life. To improve our situation all we have to do is work harder and waste less. I’d recommend for a start that we put the Army to work growing as many soybeans as are needed to supply its own protein requirements, while the Navy can catch fish. This would not only reduce the pressure on food prices but free enough federal funds so that the government can restore job-training programs for the poor. Thus little by little we’d get back to work again.

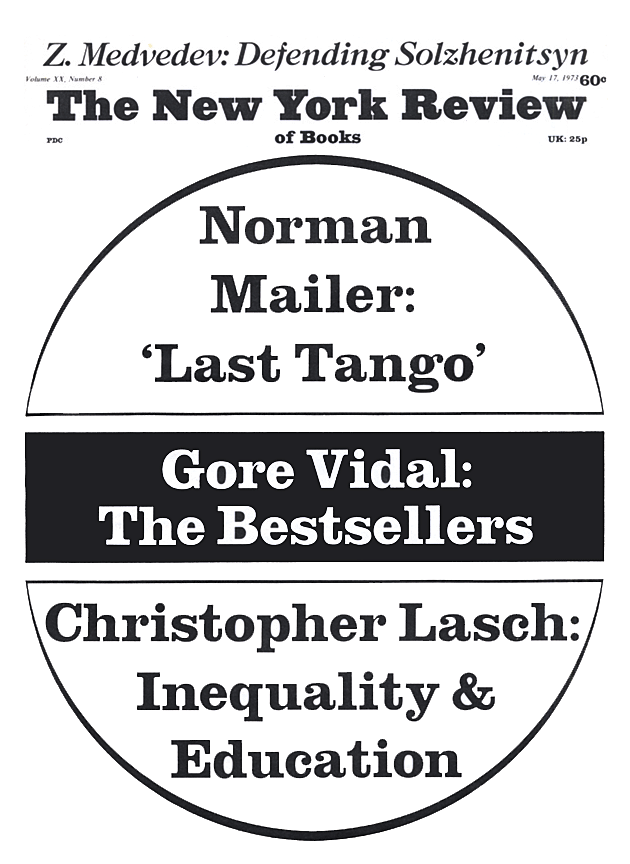

This Issue

May 17, 1973