The legislation enacting Reaganomics may now be mostly gone, but the economic legacy of Ronald Reagan remains. Perhaps more important, the political attitudes that made many Americans so receptive to the Reagan program in the first place remain as well. One of the most significant lessons to be drawn from the exhausting 1990 battle over federal tax and spending policies is simply that so many Americans are no more willing today to make the sacrifices needed to rectify the nation’s fiscal imbalance—either to cut back middle-class entitlements or to eliminate jobs in defense industries, and certainly not to pay higher taxes—than they were when Ronald Reagan first assured them there was no need to do so.

The compromise five-year budget package finally approved by the Congress and signed by President Bush does mark a major change, both economically and politically. If they remain in place, the tax and spending measures that the new agreement includes will significantly shift the government’s fiscal trajectory. The political era in which tax rates were flexible only downward has now ended, and greater tax revenues will be a part of that difference. The commitment to a virtually unlimited military budget had actually ended during President Reagan’s second term (no thanks to Mr. Reagan himself), and the new five-year package holds defense spending in check even though outright reductions beyond the trivial remain elusive. The new plan also cuts Medicare subsidies, farm supports, the Post Office budget, and other elements of domestic spending. Even after allowing for the usual pathetically obvious unrealism of the economic assumptions used to translate specific policy actions into projections of overall revenue and expenditure totals, the combination of these three changes will staunch if not reverse the persistently widening imbalance that marked what was the Reagan fiscal policy and was becoming the Bush policy as well.

Even so, the Reagan legacy—the consequence of having sustained that imbalance for so long—is still very much with us. By now the objective realities created by an entire decade of over-borrowing and under-investing, including especially the shrinking supply of “good” jobs and the parallel failure of the average worker’s wage to keep up with inflation, are familiar enough. So too are the signs, increasingly frequent and ever harder to ignore, of the loss of American influence in international economic relations following a decade of borrowing from abroad and selling off national assets. This summer’s Persian Gulf invasion marked the first international crisis in decades in which the dollar fell instead of rallying. Since then Americans have watched the spectacle of our public officials, from Secretary of State Baker on down, going about the world, begging bowl in hand, soliciting contributions to finance what we can no longer afford on our own. Because no change in fiscal policy can suddenly wish into being the factories and machines that the nation failed to build during the last ten years, or magically erase the debts that it incurred, these aspects of the Reagan legacy will continue to shape our economic prospects for years to come, no matter how much we now raise taxes or cut government spending.

More fundamentally, when we consider the moral obligations that the members of any society either do or do not accept in their relationships with one another, both individually and in the aggregate, it seems still to be true that many Americans reject any notion of their own responsibility for the government’s chronic fiscal imbalance and its consequences, as well as any need that they should join in correcting it. Who, after all, thinks he pays too little in taxes? Who thinks his Social Security check is too big? Who thinks his parents pay too little for medical care? Whatever people may believe about the abstractions that so often dominate the public debate over our nation’s fiscal policies, the 1990 budget battle showed that many Americans even now remain unwilling to accept the basic truth of the matter. Despite all the self-reassuring accusations to the effect that “they” (Are they the poor? the ill? the elderly? defense contractors? farmers?) are bleeding “our” pocketbooks, our basic problem is that members of the average American family insist on government services—for themselves, for their parents, and for their children—that cost more than what they are willing to pay in taxes.

Economic Fundamentals: Opportunity or Danger?

Two important economic developments powerfully shaped the way most Americans viewed what the President and the Congress did. First, the dramatic increase in economic inequality among Americans in recent years inevitably brought into sharp focus the question of how to distribute whatever sacrifices the new fiscal measures would entail. Before the 1980s, a standard way to duck potentially fractious debates about whether the American system of mixed capitalism tended toward a more or less equal distribution of wealth and incomes was to complain that, because of the paucity of hard data about who owns what, no one could really say. That answer no longer suffices. Within the last ten years the difference between rich and poor has widened in ways that are easily visible despite the continuing absence of precise data.

Advertisement

Even within the limited sphere of wages earned by those who are working, the change has been startling. In 1979, college-educated workers earned 47 percent more on average than those with just high-school educations. Today the gap is 67 percent. Ten years ago the chief executive officers of the nation’s 300 largest companies made on average 29 times what the typical manufacturing worker made. Now the multiple is 93 to 1. The enormous changes in asset values in recent years—and hence the widening gap between families who already owned houses before the price explosion of the 1970s and those who now can’t afford to buy one, or between investors who participated in the 1982–1987 stock market boom and everyone who didn’t—only exaggerate the overall distortion.

Especially against the background of this widening inequality, any call for sacrifice by large numbers of families would naturally have raised the issue of “fairness.” But concerns over inequality carry a different burden when, on average, incomes are rising from when incomes are stagnant or even falling. If most families were earning more today than they were a few years ago, the air would be full of talk about how a rising tide lifts most boats, albeit by uneven amounts, and unfortunately leaves a few behind. The reality, and hence the prevailing attitude, is far different. In 1990 not that many Americans are, in Ronald Reagan’s famous phrase, better off than they were, four (or even eight) years ago.

The second economic development of the 1980s that powerfully influenced the political environment within which the 1990 budget battle took place is simply that the average American family is losing ground, and knows it. The steep decline in earning power that began with the first OPEC oil shock and, after a respite in the late 1970s, extended through the Reagan-Volcker recession was bad enough. But at least the families who suffered through it could see some identifiable problems on which to lay the blame, including oil prices that went in two stages from $3 per barrel to $30, and then the need for a period of economic slack—in fact, the most severe business downturn since the depression of the 1930s—to halt spiraling inflation. By the mid-1980s, however, with oil prices falling and inflation under control, and the Reagan administration proclaiming a new era of economic expansion, people thought they had earned the right to incomes that would once again be rising.

They were wrong. In 1983, the first year of the new expansion of the economy, the average American worker in business earned $281 per week. That expansion will probably end soon, if it has not ended already, but even so it has fulfilled one part of the promise held out for it by becoming the longest running economic expansion in American peacetime experience. It has failed, however, to deliver the rising real wages that have accompanied previous expansions. Wage increases outdistanced inflation (barely) in only two years out of the next seven, and by mid-1990 the average worker was earning just $267 per week in 1983 dollars.

These two fundamental economic developments of the 1980s, widening inequality and a declining average income, are not independent of each other; nor is either unrelated to the fiscal policies that the nation has pursued. On average since 1980 the federal government’s borrowing has absorbed nearly three fourths of all net saving done by American families and businesses combined. As a result, the share of the nation’s income devoted to net investment in new plants and equipment has been lower than at any time since World War II. The absence of new factories and new machines has, in turn, not only restricted productivity growth and therefore wage growth in the nation’s basic industries but also sharply curtailed the supply of jobs that these industries have to offer.

Jobs in manufacturing still pay about one third more, on average, than jobs in other industries, just as they did in the late 1970s. The difference is that today there are fewer of them. In 1979 American manufacturing firms employed just over 21 million workers. By the time the 1981–1982 recession ended, 18.2 million were left. Today, after nearly eight years of recovery and expansion, there are just 19.1 million. This makes the 1980s the first decade since the Industrial Revolution in which the number of Americans working in manufacturing has fallen.

From one perspective, of course, the fact that two thirds of the manufacturing jobs lost in the 1981–1982 recession disappeared permanently meant “leaner and meaner” companies that could afford to pay higher executive salaries and still generate ample profit to stimulate sharply rising stock prices. But an entire decade of shrinking employment in the sector of the economy that has traditionally provided the nation’s largest source of high-wage jobs has also depressed living standards on average throughout the work force. And it has importantly contributed to widening inequality by taking away what used to be the greatest opportunity for most workers who could not afford college. After we allow for inflation, young high-school-educated males—the group most likely to compete for manufacturing jobs—now earn 18 percent less on average than in 1979.

Advertisement

The combination of widening inequality and a declining average wage may be understandable as the result of the economic policies America has followed during the last ten years, but that does not make the combination any the less potent as a political force. Indeed, most observers who have recognized these fundamental developments, and have inferred that they work to the advantage of one political party or the other (typically the Democrats), have probably underestimated the variety and the volatility of the likely public responses. Awareness that one’s own economic situation has deteriorated, envy toward those who have somehow gotten ahead, frustration over the nation’s increasing impotence in world affairs, and a general sense of discouragement that any of these trends will be reversed in the future—these all breed the kind of popular reaction that can be difficult for conventional politicians of either party to address. The result is a political climate in which departures from the norm in all directions, ranging from the promisingly innovative to the frighteningly ugly, may flourish.

Spending Limits: A Conceptual Change

At the end of a publicly humiliating process of hesitation, posturing, and mutual recrimination, the President and the Congress finally agreed on a set of tax and spending measures that can be construed, if viewed through appropriately colored lenses, to narrow the federal deficit over the next five years by some $400–500 billion compared to the deficit that the government would otherwise have run. This achievement is far different, of course, from actually shrinking the deficit. After all, a major reason for raising taxes and cutting spending in the first place was presumably the realization that without such politically unpopular measures, the deficit—and hence the absorption of private saving by government borrowing, and hence the drain on the nation’s ability to invest, and so on—would have grown steadily larger. Now federal spending and revenues will begin to draw more closely into line, at least once the period of economic weakness that is now beginning has ended.

In the final analysis, however, the aspect of the new agreement that may well prove more significant than the specific tax hikes and spending cuts enacted, or even whatever actual deficit reduction they ultimately produce, is the conceptually new approach to federal budgeting in the new legislation. An important distinction between different approaches to limiting the federal government over the last decade is the one between deficit limits and spending limits. The deficit-limit approach—represented, for example, by the 1985 Gramm-Rudman-Hollings legislation mandating a specific deficit ceiling for each subsequent fiscal year, or in more extreme form by the proposed constitutional amendment requiring a balanced budget—in principle allows the government to spend at any level the Congress and the president approve, so long as they also raise sufficient revenues to match that spending, less the allowed deficit (if any).

The main current economic issue that the deficit-limit approach addresses is the balance between the nation’s saving and investment. The goal is to restrict the government’s absorption of private saving and hence to foster greater investment that will result in a sound and prosperous economy in the future. In addition, since government borrowing today means greater interest payments tomorrow, at a deeper level the deficit-limit approach also addresses the extent to which citizens who are enjoying government services but not fully paying for them on a current basis are consequently burdening future generations. The need either to pay higher taxes or to curtail programs like Medicare or Social Security later on, in order to meet the higher debt service obligations inherited from today’s deficits, will only compound the erosion in living standards resulting from whatever slowing of overall economic growth occurs as a result of stunting current investment in productive facilities.

The chief shortcoming of the deficit-limit approach, amply demonstrated by the post-1985 experience, is that legislating deficit ceilings is not the same as actually keeping the deficit within them. The President and the Congress can simply agree to raise the previously legislated targets—as they did with the 1987 revision of Gramm-Rudman, and again with the newly enacted budget package for 1991–1995. Even more worrisome is the demonstrated willingness to misrepresent the true deficit picture.

Apart from the usual concerns about deceptive accounting practices, which apply after the fact as well as before, a central problem in carrying out the Gramm-Rudman legislation has been that although the government’s actual deficit is known only after the fact, the mechanics of automatic spending cuts require knowledge in advance. In practice the relevant enforcement procedures must therefore rely on prior estimates, which the responsible officials have been all too willing to distort as needed. A year ago, for example, Budget Director Richard Darman certified to the Congress that the deficit for the fiscal year that ended this past September 30 would fall within the 1990 Gramm-Rudman ceiling of $100 billion (plus the allowable leeway of another $10 billion). Just last February, President Bush sent to the Congress a budget statement indicating that the 1990 deficit would be $124 billion, and projecting a deficit for 1991 that would come within this year’s Gramm-Rudman ceiling of $64 billion after only modest policy changes. In fact, the 1990 deficit (measured on a basis consistent with these earlier estimates) was neither $100 billion nor $124 billion, but $220 billion, and the administration now projects that without the new tax increases and spending cuts the 1991 deficit would be $253 billion (or $157 billion without the savings and loan bailout).

In contrast to the deficit-limit approach, the spending-limit approach places ceilings directly on what the government can spend, and leaves open the choice whether to finance that spending by taxes or by borrowing. The principal economic issue addressed by the spending-limit approach is the level of the government’s total claim on the nation’s overall production of goods and services, including goods and services that the government uses directly in its own activities (for example, ships bought for the Navy) as well as funds that it recycles back into the private sector to enable others to pay for their consumption (for example, via Social Security benefits).

If the government always financed an extra dollar of spending with an extra dollar of taxes, limiting spending would amount to the same thing as limiting the deficit. If the public’s spending and saving behavior responded to greater government borrowing in the same way that it responded to higher taxes, a limit on spending and a limit on the deficit might differ but the difference would have no real economic impact because private saving would go up in step with larger government deficits.

In fact, however, since 1980 the government has not necessarily (or even usually) financed additional spending with additional taxes. Moreover, the public, in its spending and saving, has not reacted to enlarged government borrowing as it would have to higher taxes. For the most part, people took advantage of the Reagan tax cuts to increase what they spent for current consumption, so that in the face of the greatest increase in the deficit in American peacetime experience, private saving rates not only did not rise but actually fell.

Limiting spending is therefore not the same as limiting the deficit, either with respect to what the government itself does or with respect to the government’s actions on the economy. But although there have been advocates of direct spending limits, in either legislative or constitutional form, until now the government has used (however unsuccessfully) only the deficit-limit approach.

Under the new budget agreement, the Congress and the President have for the first time adopted direct year-by-year limits on federal spending. After excluding spending for entitlements (like Social Security and Medicare) and for interest on the national debt, to which such limits cannot apply even in principle, these limits apply to about 40 percent of all federal spending. Moreover, the new limits will apply separately to three distinct categories of non-entitlement non-interest spending: defense, non-defense international, and domestic. If Congress puts into a year’s budget more spending for any of these categories than the stated limit allows, the newly adopted budget machinery will set off automatic across-the-board spending cuts within that category.

Unlike under Gramm-Rudman, therefore, there is no longer an incentive for congressmen who advocate additional spending in one category, but think other spending is too high, to play against the system by voting more for the category they favor so as to exploit the consequent automatic cuts elsewhere. For example, because the old Gramm-Rudman law divided any mandated cuts evenly between defense and nondefense spending, an expenditure that exceeded the budget by $1 billion for a domestic program would, in principle, end up reducing defense spending by $500 million and leaving total domestic spending $500 million higher. (In practice, this tactic never really worked, both because congressmen with opposite spending preferences could play the same game and because the opportunity always remained to misrepresent the overall totals.) By contrast, under the new procedures the same budget-breaker would trigger $1 billion of across-the-board cuts within the domestic category only. The new system still presents incentives to play off one program against another within each major category, but advocates of specific domestic programs, for example, or specific defense programs, are more likely to be able to reach agreement on priorities among themselves.

While the conceptual change embodied in the new legislation may ultimately prove far-reaching, the actual spending limits set for the next few years represent only modest real progress. The agreement supposedly generates $67 billion of defense savings over the next three fiscal years, but these “savings” are calculated against a hypothetical baseline calling for sharply rising defense spending. The agreed limit on defense spending declines only to $293 billion in 1993, compared to actual spending of $299 billion in 1990. Moreover, even these limits explicitly exclude the extra expense of Operation Desert Shield. The much-touted “peace dividend” proved simply not usable, probably in large measure because so much of today’s military budget—including not just low-income jobs staffing bases we no longer need but also high-income jobs producing weapons systems we do not need either—is really a part of the particular late-twentieth-century American version of the welfare state. Similarly, the limit on international spending rises to $20 billion in 1993, while that for domestic spending rises to $222 billion, compared to actual spending in 1990 of $18 and $185 billion respectively. All this may be described as progress, at least in relation to what would have happened in the absence of a new budget agreement, but even so it is disappointing, to say the least.

Deficit Limits and Taxes: Déjà Vu on Gramm-Rudman?

Taxes matter too, of course, as the controversy over President Bush’s reneging on his “Read my lips” promise made clear. Surely there can be few serious defenders of the economic logic behind the grab bag of miscellaneous tax changes finally adopted as part of the compromise package: higher rates on gasoline, tobacco, and alcohol products; an increase to $125,000 in the annual wages subject to the health insurance portion of the payroll tax; an increase from 28 to 31 percent in the marginal income tax for high-income taxpayers, together with a partial loss of deductions that makes the true rate more like 32 percent; a 10 percent luxury tax on certain expensive consumer purchases; and an assortment of other nuisances such as the $100 million per year in excise taxes earmarked for the Leaking Underground Storage Tank (LUST) Trust Fund. Taken all together, however, the resulting increase in revenues adds up to $146 billion out of a supposed $492 billion of overall deficit reduction over five years.

Far more importantly, the mere fact that so many tax rates are now going up, including especially the marginal income tax rate at the top of the scale, means that the era in which tax increases could not have a part in practical deficit reduction strategies is over. The tax component of this package re-calls nothing so much as Dr. Johnson’s reference to the dog walking on its hind legs: What matters is not that it was done well, but that it was done at all.

The procedural reason why tax increases matter along with spending cuts is that the new budget system leaves the Gramm-Rudman deficit ceilings—redefined, and at higher levels—in place along with the new spending limits. The new system therefore combines both spending-limit and deficit-limit approaches. At least in principle, any legislation that reduces revenues, and is not matched by comparable spending reductions, will trigger automatic, across-the-board spending cuts affecting defense, international, and domestic programs.

Under the revised Gramm-Rudman targets adopted in 1987, the deficit ceiling was $64 billion for the current (1991) fiscal year and zero—that is, a balanced budget—thereafter. The new budget agreement raises this year’s target for the deficit to an astonishing $327 billion, although the new “deficit” concept for this purpose does not count the excess of contributions and interest received over benefits paid ($74 billion this year) that is accumulating in the Social Security Trust Fund. The stated $327 billion deficit for 1991 therefore represents an overall deficit, roughly equivalent to the government’s total borrowing requirement, of $253 billion. Because the original Gramm-Rudman law was enacted before anyone knew (or at least admitted publicly) the scale of the savings and loan bailout, for purposes of comparison to the old deficit ceiling it probably makes sense to exclude from this sum the $96 billion that the government will spend this year to rescue insolvent thrift institutions. Even so, the remaining $157 billion is a far distance from the $64 billion target at which the government was supposedly aiming just last spring.

After a deficit of $327 billion this year (on the new basis, excluding the Social Security surplus), the new budget agreement calls for only minimal progress down to $317 billion next year, and then more rapid gains, finally leading to a deficit of $83 billion in 1995. By then, however, the Social Security surplus will be much larger, and the need to spend money to resolve savings and loan insolvencies will (supposedly) have ended, so that the stated $83 billion 1995 budget “deficit” will correspond to a healthy cash surplus for the government on a consolidated basis.

Beyond these redefinitions of concepts and revisions of the stated ceiling amounts, however, the important change in how the deficit ceilings work under the new legislation is that each year’s ceiling through 1995 will automatically be adjusted to reflect any changes in economic assumptions from those specified in the compromise package. Between 1991 and 1995 these assumptions call, on average, for real economic expansion at 3.3 percent per year, price inflation at 3.4 percent per year, unemployment equal to 5.7 percent of the labor force, and an interest rate (on Treasury bills) of 5.3 percent. Such a combination of rapid growth, slowing inflation, low unemployment, and low interest rates would, to put it politely, come as a pleasant surprise.

For example, if business does grow at an average 3.3 percent per year over the next five years, inflation will probably be faster than 3.4 percent and interest rates higher than 5.3 percent, and so the government’s interest payments will be larger than projected in the agreement. Conversely, if inflation and interest rates are as low as the agreement assumes, that will probably be because real growth on average falls short of the assumed 3.3 percent, and unemployment is above 5.7 percent. In that case tax receipts will be smaller, and spending for relief payments greater, than projected in the agreement. Neither outcome would violate the deficit ceilings, however, because under the new rules those ceilings refer to what the deficit would be if the economy were as the legislation assumes it to be.

In one way, these new rules make sense. The government has, in effect, adopted a target for the deficit based on what the deficit would be if the economy maintained an employment rate not far above a reasonable guess (say 5 percent or so) at what level constitutes “full employment”—in other words a target for something very near to the so-called structural deficit, in contrast to the target for the actual deficit under the previous legislation. The change is clearly a conceptual improvement. There is no longer a risk of facing automatic spending cuts (or enacting tax increases so as to prevent them) merely because a slipping economy is depressing tax revenues and swelling some categories of spending. In such a case the ceiling applicable to the actual deficit would automatically rise. Informed discussions of fiscal policy usually concentrate on the structural deficit instead of the actual deficit, and so too should the relevant legislation.

The problem is that the new rules also intensify the already strong incentives for the government’s economists to adopt absurdly Polyanna-like assumptions. Highly respected professionals, in private life either senior officers of major financial institutions or distinguished professors at world-class universities, regularly, as government officials, offer and defend economic forecasts that in their previous (and subsequent) incarnations they would hardly entertain without giggling. Because the new five-year budget agreement is a prime example of this phenomenon, only after extensive recalculation is it possible to estimate what the deficit in 1995 is actually likely to be as a consequence of the tax and spending changes that the agreement includes. It is not hard, however, to guess that the answer is bigger—a lot bigger—than $83 billion.

And After 1993: Will It Work?

In the end, what President Bush and the Congress will have achieved from their labors will not be a matter of the economic assumptions they used, or of the specific composition of the tax and spending actions on which they agreed, but of whether the new procedures that they put in place endure and whether they or their successors follow their lead with new action after the next election. By at least halting the growth of the government’s fiscal imbalance, which was beginning to grow explosively under the existing tax and spending policies, the President and the Congress took an undeniably important step. Especially for Mr. Bush, making higher taxes a significant part of it required substantial courage. But a deficit that would still equal some 3 percent of the national income in 1993, even under the rosiest of economic conditions, can hardly be the end of the story.

Indeed, the agreement that President Bush and the Congress reached seems intentionally designed to be revisited after the 1992 election—say, in the spring of 1993, when the president submits his proposed budget for the 1994 fiscal year (which will begin that October). One telltale sign is simply that the implied target for the deficit, exclusive of both Social Security and the savings and loan bailout, declines by only $7 billion per year on average through fiscal 1993, but then by an average $45 billion per year in 1994 and 1995. Another reason is that by then the agreement’s economic assumptions will probably be so at variance with reality that, notwithstanding the analytic appeal of the structural deficit concept in principle, more and more responsible people will find the budget targets set this autumn increasingly meaningless: the government will be asserting, accurately, that it is meeting its targets for deficit reduction even if the actual deficit is not shrinking and even if there is no recession on which to lay the blame.

The clincher is that the package as adopted specifies separate limits for defense, international and domestic spending only through fiscal year 1993. For both 1994 and 1995 the agreement merely gives an overall ceiling for total spending excluding expenditures for interest and entitlements. How to divide that total among the three major categories is left up to the president and the Congress at the time—that is, beginning in the spring of 1993, when decisions on the fiscal 1994 budget become the nation’s current business. If the deficit reduction agreement reached after so much effort this year leads to more and better action in the same vein in 1993—when, with luck, business conditions will be more conducive to tax increases and spending cuts than they are now—then it will have been a job well done despite all its inadequacies when taken on its face. But if it merely provides a way to get through the next three years by pretending that the serious action will begin thereafter, it will have accomplished little.

A Final Puzzle: Why Now?

One last puzzle remains: Why did President Bush choose just this time to launch a deficit reduction effort that not only involved his abrogating the one pledge from the 1988 election campaign that just about every voter remembered but also now threatens to worsen an already impending business downturn? Can it possibly be that the man who labeled the Reagan fiscal policy “Voodoo economics” ten years ago, but then kept his mouth shut for eight years as vice-president, rediscovered the truth after a little more than a year in the higher office? After campaigning two years ago on the by then tired claim that the red line and the blue line would cross soon enough on their own, and after presenting the usual optimistic story as recently as last February’s budget message, why did Mr. Bush suddenly decide in June—just as signs of economic softness were increasing—that the time had come to reduce spending and even raise taxes?

The fact of the matter, after all, is that the worst time to reduce spending or raise taxes is in a weakening economy. Even outspoken advocates of deficit reduction have acknowledged (or should have if they haven’t) that spending cuts and tax increases will depress business activity, at least for a while. If the Federal Reserve System does its job correctly, and now meaningfully eases its monetary policy in response to the fact of the budget agreement (the 1/4 percent reduction in the federal funds rate up to the time of writing is woefully insufficent), then after a year or so the expansionary effect of lower interest rates will probably about offset the contractionary effect of lower spending and higher taxes. But that is likely only because the agreement was “backloaded,” with relatively little of the intended overall deficit reduction slated for the first year or two, rather than “frontloaded” as would have made more sense in a stronger economy.

In questions of economic policy, as in so many others, delay is often costly. In this case failing to address the deficit problem in 1985, or 1987—or even 1989—not only allowed the nation’s over-borrowing and under-investing to continue that much longer; it also sacrificed the opportunity to take the necessary measures when the economy was far stronger. Now, the measures adopted amount to much less than is needed, and even so they will at first aggravate on already weakening economic situation. That is a large price to pay for maintaining an infatuation with the nostalgic fictions offered by our last president, or for allowing his successor a comfortable grace period to get out from under a campaign promise he should never have made in the first place.

—November 21, 1990

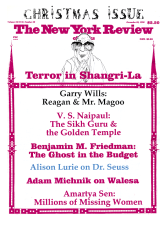

This Issue

December 20, 1990