Two decades ago, Congress swept aside the concerns of the big three auto companies, the major oil and steel companies, the powerful mining and construction industries—in effect, the most powerful economic interests in the country. The Congress did so when it set price controls on oil, enacted tough restrictions on air and water pollution, created a Consumer Product Safety Commission, and established the Occupational Health and Safety Administration.

Within the next ten years, however, the House and Senate took an entirely different direction. In 1980, just before the election of Ronald Reagan and a Republican Senate, both branches of the Democratic Congress competed to pass amendments exempting from federal regulation the funeral home industry, used car dealers, the insurance business, and agricultural cooperatives. That year, a group of corporate lobbyists known as the Carlton Group (for the Sheraton Carlton Hotel, where breakfast sessions were held) met every week to formulate what would become the corporate provisions of Reagan’s 1981 tax bill. Both the Congress and the administration had, in effect, ceded legislative authority to an alliance made up of the leading lobbies of big and small business, including the US Chamber of Commerce, the Business Roundtable, the National Federation of Independent Business, and the American Business Conference.

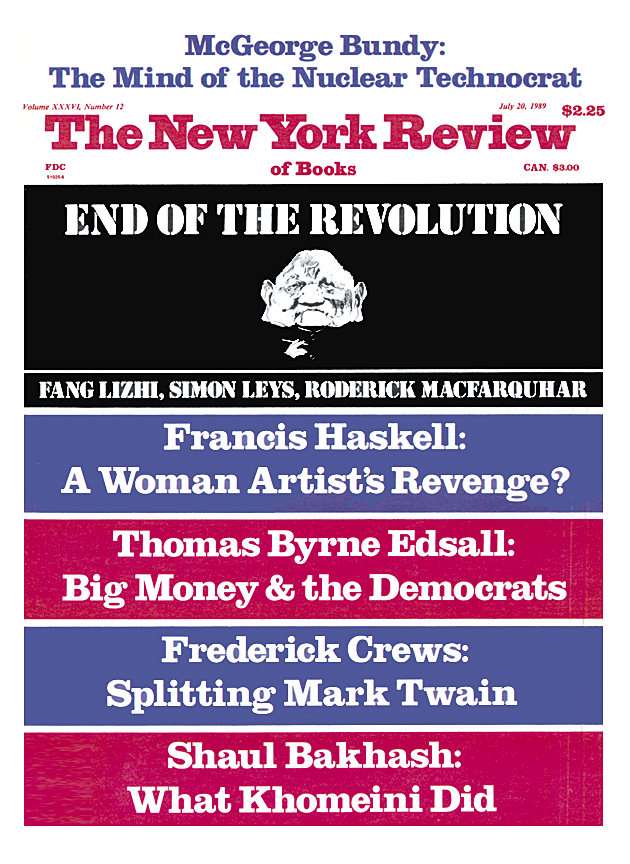

For the Democratic party, the shifting political influence of the business lobbies has created a major dilemma: the party wants to portray itself as the advocate of working men and women, while the costs of elections put the party under growing pressures to raise campaign contributions from business people who want their own interests protected. The larger circumstances surrounding the forced resignations of Jim Wright, the House Speaker, and Tony Coelho, the House majority whip, suggest how destructive this conflict can become.

Both Wright and Coelho were involved in the intrigues over the collapse and subsequent rescue of the savings and loan industry. George Mallick, the Fort Worth developer whose payments to Wright and to Wright’s wife were central to the charges filed last April by the House Ethics Committee, was an active promoter of the Texas savings and loan industry. Thomas Spiegel, who arranged for Coelho to buy a $100,000 junk bond under questionable conditions, is chairman of the Columbia Savings and Loan of California, a firm whose dealings with Michael Milken of Drexel Burnham are under investigation by federal prosecutors in New York. The collapse of the S&L industry will cost taxpayers upward of $100 billion and will, as the scope of the accompanying corruption, profiteering, and damage to the economy becomes apparent, have lasting political repercussions.

Democratic leaders contend that the party will quickly recover from the crisis provoked by the resignations of Coelho and Wright. But the resignations can be taken as more evidence of the continuing deterioration of the Democratic party from serving as the voice of most American voters to a party identified as the representative of “special interests.” Private Republican and Democratic polls show that during the past twenty years the Democrats have lost ground to the Republicans on such questions as which party better represents the interests of working men and women, which party is more likely to produce a strong economy, and which party can be expected to provide for better education.

Polls conducted by Market Opinion Research for the Republican National Committee show that when voters are asked, for example, which party is better able to handle the problem of unemployment, the Democrats and Republicans are now in a virtual tie. This is an issue on which the Democrats had a forty-point advantage in 1974 and even a twenty-two-point advantage at the height of stagflation during the Carter administration in 1979. As recently as 1984, the Democrats had a twenty-point advantage in a poll asking which party was best equipped to improve the quality of education. That advantage has fallen to no more than six points. At the same time, the GOP’s advantage as the party more likely to control inflation and keep down taxes has risen sharply from eight points at the start of the decade to a decisive thirty-five-point lead in 1989. In 1984, the Democrats held a twelve-point edge as the party more likely to win nuclear arms control agreements: the GOP now holds an advantage of more than thirty points in foreign affairs.

A major reason for the continuing deterioration of the Democratic party derives from the tactics the party used to respond to the emergence, during the late 1970s and early 1980s, of an increasingly unified coalition of American business that was prepared to back the Republican party in its drive to achieve a national majority. Two recent books, David Vogel’s Fluctuating Fortunes and Brooks Jackson’s Honest Graft, illuminate the powerful business forces at work on both parties. Vogel, professor of business and public policy at the University of California, Berkeley, provides in Fluctuating Fortunes a historical and scholarly account of the resurgence of the political influence of business from the low point between 1969 and 1972, when “virtually the entire American business community experienced a series of political setbacks without parallel in the postwar period.” Congress then

Advertisement

enacted the most progressive tax bill in the postwar period, reduced the oil-depletion allowance, imposed price controls on oil, transferred the primary authority for the regulation of both pollution and occupational health and safety from the states to the federal government, established the Consumer Product Safety Commission, and banned the advertising of cigarettes from radio and television.

Corporations and trade associations as diverse as Atlantic Richfield, the Realtors, Sears Roebuck, Philip Morris, Tenneco, Pfizer, the American Medical Association, CitiCorp, and E.F. Hutton decided to retaliate. They persuaded other businesses to become politically active, formed political action committees (PACs), and turned executive, middle-level managers, shareholders, and members into an army of “grass-roots” lobbyists. They bombarded Congress with letters attacking regulations and favoring tax cuts, and they formed committees of home-town, probusiness advocates in the districts of key members of Congress across the country.

Many corporations in 1980 abandoned the cautious strategy of backing incumbent senators or congressmen, Democrat or Republican, and they invested heavily in defeating liberal Democratic incumbents. One third of all corporate PAC money that year, Vogel writes, “went to support conservative Republicans who were challenging incumbent liberal Democrats.” The corporations involved in politics could take much of the credit for the election of Ronald Reagan, of a Republican Senate, and of enough Republicans in the House of Representatives to establish a conservative majority that, for a year and a half, could thumb its collective nose at Speaker Tip O’Neill. This victory was the closest the country had come since the 1930s to a broad political realignment.

Brooks Jackson, a member of The Wall Street Journal’s Washington bureau and a specialist in campaign finance, describes in Honest Graft the Democrats’ desperate, and largely successful, drive to halt the business-financed resurgence of the GOP and to restore Democratic dominance in Congress. Central to Jackson’s book is the story of how Tony Coelho, the forty-six-year-old California congressman serving as chairman of the Democratic Congressional Campaign Committee, set out to break the loyalty of business to the GOP. By his own account, Coelho went to the leaders of corporate PACs and told them, in effect: “You people are determined to get rid of the Democratic Party. The records show it. I just want you to know we [the Democrats] are going to be in the majority [in Congress] for many, many years and I don’t think it makes good business sense for you to try to destroy us.” His executive director at the campaign committee was more direct in describing Coelho’s tactics:

He delivered the following message: “The Democrats are in the majority, and you might want to think about what is in your best business interest…. Democratic committee chairmen might not be happy to know you are trying to make them the ranking minority member.” Is that extortion? I don’t think so. Is that hardball? You bet.1

Coelho’s schemes for fund raising had few limits. At one point he sought to unite pro-Israel PAC leaders and independent oilmen from the southwest to support legislation increasing the tax incentives for oil drilling on the theory that the more oil produced in the US, the less the dependence on Arab states, and consequently, there would be less economic pressure to weaken ties to Israel. Similarly, Coelho persuaded a considerable number of Armenian-Americans to become donors to the Congressional Campaign Committee by sponsoring legislation commemorating April 24 as the anniversary of the 1915 Turkish massacre of Armenians.

Honest Graft is much more than a tale of fund raising. Although the last chapter of Jackson’s book was written well before the ethics committee findings about Wright were announced and before Coelho’s junk-bond dealings were made public, he still provides the basic outlines of Wright’s financial manipulations, and sets the stage for the downfall of the two Democrats. While Vogel’s Fluctuating Fortunes places the events described in Jackson’s book in a larger setting, Jackson’s dogged reporting makes it possible to understand how two of the most powerful members of the House of Representatives could become enmeshed in the struggles of one troubled industry, savings and loans.

Unlike the drug and chemical industries, which faced broad environmental, health, and safety regulation, and therefore have been more inclined to support the GOP as the party opposed to government regulatory intervention, the savings and loan industry had come to treat government as an ally. Lax federal supervision and beneficial congressional legislation combined to create opportunities for extraordinary profiteering. The savings and loan industry was in a perfect position to take advantage of both the Reagan administration’s hostility to regulation and the willingness of powerful Democratic leaders to bend over backward to help an industry that was ready to pour cash into congressional campaigns.

Advertisement

“Years of unwise decisions by Congress had made it possible for unscrupulous operators to achieve enormous profits,” Jackson writes.

In 1980, for example [Rhode Island Democrat and House Banking Committee Chairman Fernand] St. Germain pulled off a coup that increased to $100,000, from $40,000, the amount of any single S&L savings deposit insured by the federal government…. With their deposits insured up to $100,000, the associations no longer had to rely on the savings of citizens in their own communities. A huge, unregulated national market in brokered deposits developed. Corporations and wealthy individuals found they could split up their spare millions into convenient $100,000 bundles and park them as federally insured certificates of deposit in S&Ls all over the country.

Thomas Gaubert, a Dallas entrepreneur, was particularly bold in exploiting the opportunities for profit and political manipulation offered by this federally subsidized industry. Gaubert, by Jackson’s account, bought a

tiny S&L in Grand Prairie, Texas, for $1 million cash. In the reckless and permissive atmosphere that Congress had created in the industry, Gaubert was able to increase the S&L’s assets from $40 million to $223 million in less than a year, attracting short-term deposits by paying exceptionally high interest rates.

Gaubert was first recruited as a Democratic donor by Coelho. After joining the $5,000-a-head “Speaker’s Club” of Coelho’s Democratic Congressional Campaign Committee in 1983, Gaubert

wrote a flurry of checks to House, Senate, and presidential candidates. He began traveling to Washington regularly, attending Democratic Party briefings, dinners, and fund-raisers…. “I started being able to have a dialogue with different members of Congress,” Gaubert recalled….Coelho encouraged Gaubert to take a second look at his [hometown] congressman, Jim Wright, whom Gaubert had previously considered too liberal. With Coelho as matchmaker, Gaubert warmed to Wright and became one of the Majority Leader’s principal financial backers.

The turning point in the relationship between Gaubert and Wright came in 1985, after the Reagan landslide. Through the appointment of a congressman to a federal judgeship, the first congressional district of Texas became vacant, and the Republican party decided to turn the special election into a test of whether a district that had been Democratic for a century could be taken over by the GOP. The race became a critical test for the political ambitions of both Wright and Coelho: a defeat would be a sign of weakness that could ruin Wright’s plans to become Speaker and Coelho’s plans to run for majority whip. Gaubert, by law, was limited to contributing only $1,000 to the Democratic candidate, James Chapman. To get around this limitation, Gaubert set up an “independent” PAC, called East Texas First. PACs, which were authorized by the “reforms” of the 1974 campaign finance law, serve as conduits for the collection of contributions from individual donors. They can either be used to make direct contributions of up to $5,000 to federal candidates, or they can be used to finance unlimited contributions in support of, or in opposition to, federal candidates if the contributions are made “independently,” i.e., without any overt cooperation or coordination with the candidates.

All but a few of the 4,828 PACs currently active were set up by corporations, unions, and trade associations to make direct contributions to candidates. Fund raising, however, has become so important that fifty members of the House and Senate have set up their own PACs, and control over a PAC is now considered a crucial weapon for those seeking leadership posts. In 1986, when Coelho ran for House whip, he used his PAC, the Valley Education Fund, to disperse nearly $570,000 to House candidates, according to a Twentieth Century Fund study by Ross K. Baker.2 Wright, in turn, maintained his leadership post with the Majority Congress Committee fund for the New Leadership. In 1988 a total of 185 PACs made “independent expenditures,” a practice that gained the most notoriety when the National Conservative Political Action Committee spent millions of dollars on negative television commercials contributing to the defeat of such liberal senators as George S. McGovern and Birch Bayh in 1980. During the last presidential election, the “independent” National Security PAC did much to finance implicitly pro-Bush television commercials showing photographs of Willie Horton, the black murder-rapist released under a Massachusetts prison-furlough program.

In 1985, Gaubert’s independent PAC raised $99,121, almost all from wheelers and dealers in the S&L industry, to pay Democratic party workers on election day and to finance mailings to elderly people in the first congressional district of Texas, warning that the Republican candidate would join his GOP colleagues in attempting to cut back Social Security benefits. The Democrat, James Chapman, won by just 1,933 votes in what proved to be a critically important victory for Coelho and Wright. Wright, in return, became a committed backer of Gaubert and of the entire S&L industry. Facing intense scrutiny from Federal Home Loan Bank Board regulators and a federal grand jury, Jackson writes, “Gaubert complained to Wright. The Majority Leader meanwhile began crusading for Gaubert and other S&L operators and borrowers in Texas.” Wright sought out George Mallick, since 1963 a close friend and business partner in Fort Worth whose dealings with Wright would ultimately form the centerpiece of the House Ethics Committee investigation, to prepare a formal report on the problems of the industry.

Mallick turned in a twenty-five-page document accusing regulators of taking far too hard a line. He argued that they should show more forbearance…. Wright adopted that line as his own. His policy, which became that of the Democrats, was being influenced by Gaubert, on whom he and his party relied for campaign donations, and Mallick, on whom he relied for personal income.

Wright then put pressure on the chairman of the Federal Home Loan Bank Board, Edwin Gray, to meet personally with Gaubert. Coelho, in turn, became a leading congressional advocate of the S&L industry, whose members had become infuriated that Gray, once a public relations executive for the industry, had turned out to be in favor of tough regulation. According to Jackson,

Coelho recalled appearing at a meeting of the U.S. League of Savings Institutions, the S&L’s main lobbying arm. “A guy said, ‘Don’t give Gray his $15 billion [Bank Board appropriation] to keep harassing us and helping his friends.’ I [Coelho] said, ‘I’m not for giving Gray any more money to run amok.’ The place went wild, it absolutely went wild.”

Such machinations on behalf of the S&L industry are an extreme example of the sort of behavior that has produced a political and ethical crisis in the Democratic party. In the case of Coelho, the California Democrat was brought down by the questionable circumstances under which he made the relatively tiny profit of $6,882 on a $100,000 investment in junk bonds issued by Drexel Burnham Lambert. The bonds were purchased at the suggestion of California S&L executive Thomas Spiegel, who held the bonds for a month while Coelho arranged financing. Coelho paid the original $100,000 price, although the value of the bonds had already risen by $4,000.

Although more detailed information might have come to light had Coelho been subject to an ethics committee inquiry, the amount of money involved, and even the $145,000 that Mallick allegedly provided to Wright over a period of seven years, seems derisory in comparison to the millions of dollars in profits that investors in the S&L industry have made—not only those who milked the S&Ls dry in the early 1980s, but those who have stepped in to buy the institutions now. Since 1985, Spiegel, chairman of the Columbia Savings and Loan in California, has received $22 million in compensation. The June 19 issue of Fortune estimates that Ronald Perelman, the billionaire who bought First Texas Gibraltar S&L at the end of 1988, had made an 84 percent rate of return on his equity investment of $160 million—all in the first ninety days that he owned the company. What is damaging is not only the allegations that Wright and Coelho benefited personally in their dealings with Spiegel and Mallick but the entire history of their helpful relations with the S&L industry.

For the Democratic party, the recent resignations of Wright and Coelho may prove to be a blessing in disguise because if the two men had remained in Congress, the Republican-inspired publicity over their efforts to protect an industry whose bailout is expected to cost taxpayers $100 billion or more could have become a major liability. Their departure, however, leaves unresolved the deep problems facing the Democratic party, particularly so far as campaign financing is concerned. The Democrats, and particularly the Democrats in the House of Representatives, have become a party more and more dependent on special interests. In 1988 the Democratic incumbents in the House depended for the first time on contributions from PACs for more than half their financial support, 51.5 percent, compared to 39.5 percent from individual donors. (The rest of the money came from loans and the contributions candidates made to their own campaigns.) Incumbent House Republicans, by contrast, got 52.5 percent of their money from individual contributors and 39 percent from PACs. Of the fifty members of the House who received the most PAC money, forty-four are Democrats. Consequently, the current proposals by the Republican party to reduce the maximum a PAC can give from $5,000 to $2,500, and to shift the burden of campaign finance toward individual donors, would be far more damaging to Democrats than to the GOP.

Since PACs have now become almost exclusively organizations that corporations, trade associations, and unions use for lobbying for their particular interests, they have come to epitomize the kind of quid pro quo politics that severely undermine the claim of elected officials to represent their constituents legitimately; and the erosion of political legitimacy has been most serious among Democrats. Indeed, the recent trends in campaign finance reveal one of the essential failures of the Democratic party: it has been unable to develop a set of broad principles making it attractive to those who might give money on the basis of their beliefs. The Republican party has built a strong base of financial support among those who believe in keeping domestic spending down, in reducing tax rates, in restricting government regulation, in maintaining a strong defense, and in combating communism. The Democratic party relies far more on donors seeking to buy influence over the legislative process for their own narrow concerns. Even in its direct mail campaigns, the Democratic National Committee depends heavily on elderly voters who believe that the GOP is likely to cut Social Security benefits.

It is now evident that the pressures on the Republican party to raise money through direct mail during the mid-1970s when, owing to Watergate, the party’s sources of cash in Washington were drying up, helped the GOP to increase its ideological consistency and coherence. In 1981, when the Democrats were faced with similar financial difficulties, the party, particularly the Democratic Congressional Campaign Committee under Tony Coelho, moved in the opposite direction, selling access to legislators with little regard for principle, although Coelho later sought with some success to build a list of Democratic donors for direct mail fund raising. No doubt the fund raisers of the Republican party have an obvious advantage in that the people with the most money to contribute are the most inclined to vote Republican. Still, the US contains a large number of donors to progressive causes such as environmentalism, consumer protection, and abortion rights. The long-range task facing the Democratic party is to convert people who contribute to such causes into Democrat partisans. At the same time the party has yet to develop the general economic policies that would appeal to middle-class voters and attract their contributions.

Campaign finance has rarely been a major issue for the public—the period just after Watergate was an exception—but the resignations of Wright and Coelho open the way for a new attack on Democratic fund raising by the Republican party, one that in many respects dovetails with its attempts to characterize the Democratic party as both dominated by special interests and dependent for votes on the support of organized labor and blacks. Lee Atwater, the Republican National Committee chairman, and Ed Rollins, his counterpart at the National Republican Congressional Committee, are now determined to conduct a full-scale attack on Democratic control of the House of Representatives. They want to use the issue of campaign finance to reinforce the public image of the Democratic party as the vehicle of groups seeking special breaks—a party that lacks a broad public mandate.

Newt Gingrich, the Georgia Republican who was recently elected House minority whip, now says a chief goal of his party must be to discredit the Democratic party as a “corrupt, liberal, welfare machine.” Gingrich and a number of like-minded Republican strategists intend to portray a Democratic party as so corrupted by its power in the House that it has become dominated by politicians who line their own pockets, unions that obstruct education reform, construction unions that push up the cost of housing, and defense lawyers and civil libertarians who stand in the way of law enforcement. Central to this conservative strategy is the charge that traditional civil rights leaders, in demanding special breaks for blacks, reduce access to jobs and education for whites of equal or better qualification.

It should be clear that Republicans are now pushing for reforms in campaign financing as part of their larger strategies to discredit the Democrats. A main point of President Bush’s proposals for reform will be to make significant reductions in the amount PACs can give to candidates, if not to prohibit PACs altogether. At the moment, such restrictions would be devastating to the Democrats who will be hard pressed to produce a defense of a campaign finance system that is now in disrepute. As both parties prepare for the critical elections of 1990, in which the results of congressional, gubernatorial, and state legislative races will determine which party will gain most in the decennial redistricting of 1991–1992, every advantage, minor and major, becomes magnified in importance. So far, what advantages have been gained have accrued to the benefit of the Republican party.

This Issue

July 20, 1989