At the apparent zenith of its triumph, its enemies confounded, America seems headed for disaster. What may seem a hyperbole is only to repeat what I hear on every side. The country is visibly decaying. I do not know of anyone who sees a bright future for it.

Yet I also believe that a dramatic, and effective, program to change the direction of the economy is possible. By “possible” I mean without requiring drastic sacrifice or unrealistic improvements in social attitudes. But it cannot so confidently be asserted that the country will find the political resolve to make the changes necessary. That will depend, at least in part, on a vision of what can be done, and how to do it.

The basic facts can be briefly summarized. For almost two decades, the United States has been suffering from what the economist Wallace Peterson calls a “silent depression.” “In spite of the vaunted prosperity of the Reagan years,” he writes, “the real weekly income of a worker in 1990 was 19.1 percent below the level reached in 1973.” During the same period, average family income managed to inch ahead—a rate of improvement of 0.04 percent a year, compared with 2.72 percent over the fifteen years prior to 1973—but this near-invisible gain was only achieved because more mothers and wives entered the labor force. Thus, the overall growth in GNP has masked a serious decline in well-being.1

This seemingly contradictory state of affairs is the consequence of an unprecedented shift toward income inequality during the Reagan years. What appears to be a positive, albeit miniscule, improvement in the income of the “average” family is a statistical illusion arrived at by adding together a great many small declines with a much smaller number of substantial gains. If we look at income “deciles”—tenths—between 1977 and 1988, we discover that real incomes declined in every family decile except the highest ones. In the lowest decile, family incomes (which averaged a distressing $3,504) were 14.8 percent lower in 1988 than in 1977, in constant dollars. In the middle-income brackets—the fifth, sixth, and seventh deciles—average family incomes were lower by about 5 percent, again in inflation-adjusted terms. Even the eighth and ninth deciles—the upper middle class—saw a slight shrinkage in its real incomes, off 1.8 percent in the eighth decile, up 1.0 percent in the ninth.

Not until we reach the tenth decile ($119,635 per family in 1988) is there real growth. Here the ten-year gain, in real terms, is 16.5 percent. And if we look “inside” the top decile we can see even more plainly how GNP could rise and “average” income fall at the same time. The income of the top 5 percent of families in 1988 averaged $166,016. This was 23.4 percent over their real income in 1977. The income of the top 1 percent in 1988 averaged $404,566. This was up by 49.8 percent over the same period.2

Finally, the silent depression testifies to a decrease in productivity. During the past twenty years the value of production per worker has continued to grow, as it does in almost all except catastrophic years. But the pace of growth has steadily declined. From 1948 through 1973 the value of output per hour in the nonfarming sector grew at an average rate of 2.51 percent per year. From 1973 to 1982 the rate of growth declined almost to zero, rebounding after the 1983 recession to 1.82 percent. The difference between these two periods can be better understood when we realize that at the productivity growth rate of recent years it takes over a half century to double GNP, whereas at the rate we enjoyed before 1973 GNP doubled every twenty-eight years. That is why young people growing up in the golden years after World War II could look forward with assurance to a higher standard of living than that of their parents, whereas the young people coming of age in this generation cannot.

How can this silent depression be ended? Ideally by a new period of “transformational growth”—one of those periodic surges of expansion, based on a technology that alters the entire character of social life. The nineteenth century’s decades of railroad building were one such period; the introduction of the automobile during the early twentieth century was another. The microchip has long been heralded as the harbinger of yet another transformational boom, but it has not yet shown these powers.

Unfortunately, there is no known policy to awaken these slumbering powers of capitalism—certainly the Reagan tax cuts, aimed at galvanizing the country’s entrepreneurial energies, did not do so. There is, however, a task of pressing urgency and of potentially large rewards that lies within our grasp. This is to build up the base of public capital without which any spontaneous surge is likely to find itself seriously handicapped, perhaps even aborted.

The inadequacy of public capital in the US is by now widely acknowledged. For something like twenty years the condition of our infrastructure—our streets, highways, bridges, tunnels, airports, navigation facilities, and water and sewage systems—has been steadily deteriorating for lack of adequate investment. Today we spend on this core of public capital less than half of what we were spending in the 1950s and 1960s, in constant dollars. According to the Department of Transportation, in 1985 the wretched condition of our highways imposed a burden of 722 million hours of vehicle delay, with its toll of wasted gas and frazzled nerves; by 2005 this will be 3.9 billion hours, unless the highway system is mended.

Advertisement

Moreover, it is not only people who are delayed but shipments of goods. David Alan Aschauer, the leading authority on this “third deficit,” has calculated that a growing deficiency of the services supplied by public capital—from air navigation to mass transit efficiency, from environmental cleanup to water supply—is responsible for as much as one half of the decline in productivity growth since the 1970s. He concludes that an additional dollar spent on infrastructure may exert between two and five times as much leverage on GNP growth as an additional dollar of private investment.3 Aschauer’s position, at first viewed as somewhat extreme, is gaining public support among economists. In 1989 six Nobel Prize–winning economists were among the 327 economists who warned the Joint Economic Committee that we would not be able to maintain our current living standards without an expansion of public capital.4

An essential step in moving the country out of the silent depression is therefore to undertake an extensive program of public capital construction. Even so, some aspects of the situation cannot be directly addressed by public investment, at least in the narrow sense of bridges and roads. We suffer not only from a concealed depression but also from open and highly visible pathologies: the three million homeless, the violent drug-filled ghettos, the failing schools, the explosive racial climate. In many ways these are more obdurate problems than our rotting physical infrastructure because we know that without large-scale, long-lasting, and expensive social programs—including many that will also require new buildings and equipment—these pathologies will get worse, as they have over the last two decades.

In principle, I do not think there is much opposition to a program to improve infrastructure and strengthen social services. The Bush administration itself admits the pressing need to rebuild our physical “core capital,” meaning mainly transportation. Every opinion poll shows that homelessness and drugs and racial tension are at the very top of our national “concerns.” Why, then, is a program of large investment in infrastructure and generous social policy not more vigorously supported? The answer is simple. It costs too much. The money is not there. We cannot afford it.

There are three obvious places to look for whatever sums we will need. We can divert money from the military. We can borrow it. Or we can raise it by taxation.

The United States will probably spend a little over $300 billion on national defense in 1991. This is about the same percentage as we spent in 1952, when the cold war was still a powerful force in shaping national priorities. Hence it is entirely realistic to look to a considerable reduction in military spending for funds to be used for public investment or social policy. The only question is how much we can realistically get.

Most of the controversy over this question turns on arguments about the military or political feasibility of reducing specific programs such as the Star Wars project, the Stealth bomber, troop commitments to Europe and elsewhere. The issues are complex and highly technical and difficult for nonspecialists to judge. Hence I offer a suggestion that may give us an understandable political rationale for an appropriate defense budget—that United States military spending not exceed the combined total of all other OECD nations. Such an approach escapes the charge of being naively unconcerned about defense, while at the same time constraining us to heed the collective appraisal of military needs made by our allies. The economic consequence of such a requirement would reduce our military spending by at least one third, and perhaps as much as one half, depending on whether we matched the actual amounts spent by our allies or the percentage of GNP that both sides devoted to military purposes. Between $100 and $150 billion would thus be released to be used for revitalizing the economy.

To some, such a transfer would be much too small—after all, even the larger cut would leave us with military expenditures equal to 2.5 percent of next year’s estimated $6 trillion GNP, whereas in 1929 they were less than one half of one percent of GNP. I suspect it is more likely that even a $200 billion military budget would be considered in Washington as too small, partly because of the immense cost of modern military hardware, partly because an important function of the defense budget is to provide a kind of social support program in the form of education, training, and physical fitness (as well as income) for many of the men and women in the armed forces.

Advertisement

The point I wish to emphasize, however, is that even a 50 percent reduction in military outlays would not restore the deficit in our public capital. During the years between 1961 and 1965 we devoted about 2 percent of GNP to net public investment.5 In recent years we have been spending only 1 percent. Thus just to get back to the levels of the 1960s would require that we double our present levels of public investment. We could easily finance such a doubling from the savings in military expenditure. The trouble is, that would not bring us close to a par with Germany and Japan. Their levels of public investment have been one and a half to three times larger than ours as a proportion of GNP—that is, one and a half to three times larger per year. To catch up with our principal competitors we would have to make up the shortfall that has been accumulating year by year for at least ten years, perhaps much longer. The basic point is clear. Cutting back the military is a necessary but not a sufficient means of financing the economic and social programs we need.

The next candidate is borrowing. As readers of my essay in these pages last year may recall, I do not share the general aversion to borrowing, provided that the purpose for which it is undertaken is to finance capital investment, whether public or private.6 But establishing a capital budget for national investment—precisely analogous to the capital budgets by which corporations guide their investment operations—is not appropriate today. The reason is not that a larger deficit would “bankrupt” us. It is that we are now moving toward a deficit of well over $300 billion a year for at least the next several years, largely as a result of the S&L mess. Under these conditions, no matter how unimpeachable the argument that borrowing is a safe and appropriate method of financing public capital, it is idle to imagine that additional borrowing would receive a sympathetic hearing, even in the name of infrastructure.

That leaves additional taxation, a suggestion so unpopular as to be virtually unthinkable. I would hesitate to broach it were I not convinced that there is a way through this apparently impassable barrier. To judge by the tax phobia in this country, Americans would seem the most heavily taxed people in the world. The opposite is the truth: we are the most lightly taxed, as Louis Ferleger and Jay R. Mandle show in an important article in Challenge magazine, “Americans’ Hostility to Taxes” (July–August 1991). We can see this in Table 1 below which shows the comparative tax burden of various nations in 1987 (the latest figures available in the U.S. Statistical Abstract).

Why, then, the deep resistance to taxes in the United States? Ferleger and Mandle provide a plausible answer when they examine the manner in which these countries collect their taxes. We see the contrast in Table 2, which shows how much of each nation’s tax revenues are gained from individual income taxes and how much from sales, or value-added, or other taxes on goods and services.

One lesson stands out from this table. With the exception of Sweden (which is now radically reducing its income taxes) we extract a higher proportion of national revenues from income taxes than any other industrial nation. And with the exception of Japan, we extract a smaller percentage of revenues from taxes on goods and services than any other nation.

The inescapable conclusion is that our tax system would be much more effective if we moved closer to that used by most other Western nations. Indeed, the differences are startling. Again using $6 trillion of GNP as our tax base, we can calculate the revenues that would accrue to the United States government—state and local plus federal—if we were to achieve the tax collection results of other nations. This is shown in Table 3.

The implications are clear. If we had the tax-raising capacity of Italy, we would increase our national revenues by $400 billion; if that of Germany, by $500 billion; if that of France, by almost a trillion dollars. It follows that if the United States is to provide its private enterprise system with an infrastructure commensurate with its economic ambitions, and if it is to have sufficient resources to deal with its social problems—and should not these be the goals of the United States?—we will have to alter our tax system to resemble those of other Western capitalist economies.

How much would we then wish to raise by taxes? That depends in the first instance on how much we raise from the military and by borrowing: let us assume $150 billion from the first, and $200 billion from the second, once the S&L bailout is completed, supposedly in 1994 or 1995. Let us further assume that we decide to seek a level of tax collection equal to that of Germany before it took on the burden of rescuing the East German economy. That would yield another $500 billion, making available $850 billion in all. With that much available for public investment and general improvement—about equal to 14 percent of our GNP—we ought to be able to reverse the silent economic depression and move toward alleviating our social disorders.

Not all of this $850 billion, it must be noted, is an addition to existing public spending. The military portion is only an exchange of one purpose for another, and requires no new taxes or borrowing. The $200 billion of borrowing is approximately the amount we spend today for public capital: the only difference is that we would specifically authorize that amount of Treasury borrowing to build infrastructure, instead of mixing all government spending, whether for capital or for consumption, into one pot, with no distinction made between programs and projects to be paid for by taxes and those to be financed by debt. Hence, the only actual additional cost of the overall program lies in the $500 billion of added taxes that would be raised by the new tax approach.

Five hundred billion is not a small sum. It is almost 30 percent of what we now pay in federal, state, and local taxes. It is over 9 percent of GNP. Can so large an increase in taxation be realistically urged as a national policy?

Such a question can be addressed in two ways. The first is to inquire whether the present economic and social condition of the United States can be substantially improved for less. I do not think so, and I believe that a comparison of the US with other capitalist nations strongly supports that contention. I use the German level of tax collection as a model not because Germany is extravagant in its treatment of economic and social problems but because it is prudent and successful. I doubt that we could do better.

The second consideration is why other advanced nations don’t share our self-crippling aversion to taxation. As Ferleger and Mandle suggest, the reason is that taxes on income are considered by most taxpayers to be a kind of plunder on the part of government—seizures of money that is rightfully theirs. By contrast, taxes on goods and services may be viewed as unwelcome or burdensome, and can be politically risky, but are not perceived as government plunder. Perhaps this is because such taxes appear to have a voluntary character to them—one can decide not to buy a particular item because of its tax, whereas there is no way not to pay the tax that has been subtracted from one’s paycheck. Like many other economists, I deplore this attitude, but there seems no denying that it is deeply ingrained in our society—perhaps in all market societies. Whatever the rationale, rescuing the country’s economy is of incalculably greater importance than retaining a tax structure that is neither effective nor just.

No doubt it will be claimed that increasing our reliance on taxes on goods and services is a regressive policy, taxing the poor relatively more heavily than the rich. There are three answers to this serious objection. The first is that a reliance on income taxes is no guarantee of progressivity. According to the calculations of the late Joseph Pechman of the Brookings Institution, the United States has the lowest degree of progressivity in its total tax structure, despite its being first in reliance on income taxes. The second answer is that the regressive aspect of taxes on goods and expenditures is easily offset, and can be more than offset, by granting income tax credits for low incomes. This is the negative income tax long urged by Milton Friedman and many others. The third reply is that this program does not rule out egalitarian tax measures, such as considerably higher rates on incomes over $100,000 a year, as long as the middle income families are not exposed to levels of income tax (and possibly of property taxes) that turn it against a program to arrest American decline and decay.

A second general objection is more difficult to meet. Redesigning the existing tax structure would pose many difficult questions. How would a national value-added tax affect the existing state sales-tax structure? What would be the most politically and economically effective trade-off between higher taxes on goods and services and lower taxes on income for middle-income families? These are questions that would test the political capacities of any nation. It is possible that our political system, or our current political leaders, may not be capable of creating an effective new tax system. Much will depend on having a president willing, as Mr. Bush has not been, to explain to the country what is at stake.

In the end, I think, the determining factor will be our understanding of the present predicament. Some will claim that the idea of a government program to reverse the present trend toward disaster is a fundamental misconception of the problem—that we are in trouble because of excessive government spending, for whatever purpose, not for lack of it. This is not an argument that can be readily disposed of by evidence or logic. It is a matter of one’s perception of the situation and of what is causing it. In my view, the consequences of a failure to take bold measures to build up public capital and to address our social needs will be to continue the hidden depression and to deepen the pathologies that are afflicting American society today.

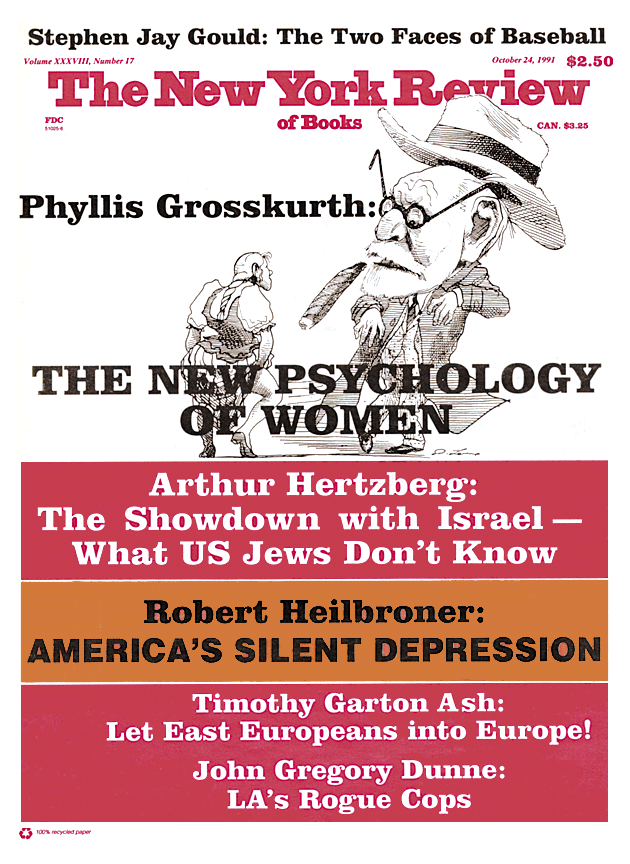

This Issue

October 24, 1991

-

1

Wallace Peterson, “The Silent Depression,” Challenge (July–August 1991), pp. 30–31. ↩

-

2

Kevin Phillips, The Politics of Rich and Poor (Random House, 1991), p. 17, Table 1. ↩

-

3

David Alan Aschauer, Public Investment and Private Sector Growth, (Economic Policy Institute, 1990), pp. 2, 3. ↩

-

4

See “Investing the Peace Dividend,” by Jeff Faux and Max Sawicky, issued recently by the Economic Policy Institute. ↩

-

5

We should note that there is no hard and fast definition of infrastructure, or of public capital. Both terms are sometimes confined to physical capital, such as buildings or earthworks, and sometimes to all expenditures that promote growth, such as education, research, and even health programs. There is also the question of whether the military equipment should be included—a question that has been answered yes and no. The percentages of GNP above refer to physical, but not military capital, and do not include research, education, or health. ↩

-

6

See “Seize the Day,” The New York Review, February 15, 1990, p. 30. ↩