We place a lot of confidence in paper money. We trust in pieces of paper that seem to have no intrinsic value whatsoever. We pass paper bills from hand to hand with little or no questioning of their worth. During some periods of American history people were able to turn in these pieces of paper to some institution or another for specie, that is, for gold or silver, which most people believe do have some intrinsic value; but not anymore. Today the paper bills rest exclusively on faith, on the confidence we have that the notes are genuine and that everyone will accept them.

Almost from the beginning of American history Americans have relied on paper money. Indeed, the Massachusetts Bay Colony in 1690 was the first government in the Western world to print paper currency in order to pay its debts. Although this paper money was not redeemable in specie, the Massachusetts government did accept it in payment for taxes. Because Americans were always severely short of gold and silver, the commercial benefits of such paper soon became obvious. Not only the thirteen British colonies, but following the Revolution the new states and the Continental Congress all came to rely on the printing of paper money to pay most of their bills. By the early nineteenth century hundreds of banks throughout the country were issuing notes that passed as money. No place in the world had more paper money flying about than did America. By the time the federal government began regulating the money supply during the Civil War, there were more than ten thousand different kinds of notes circulating in the United States.

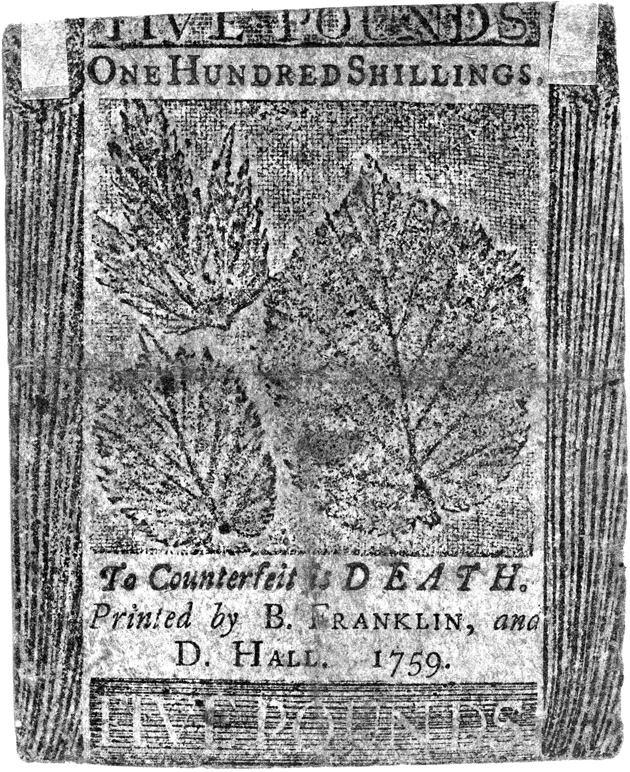

All this paper passing from person to person helped to make possible the extraordinary expansion of the American economy in the eighteenth and early nineteenth centuries. Entrepreneurs had credit and capital readily available, and anyone who wanted to trade with other Americans found this circulating paper a useful medium of exchange. At the same time, however, all these different paper notes offered abundant opportunities for criminals to make money. Counterfeiting gold and silver coins was hard to do, but someone with ink, paper, plates, a printing press, and a little talent for engraving could create fraudulent copies of notes issued by governments and banks. Slipping countless amounts of these forged notes into circulation could make someone a rich man; or at least many aspiring American counterfeiters thought so.

Not surprisingly, the prevalence of counterfeiting in early America—and no country in the eighteenth and early nineteenth centuries had more of it—has spawned a series of studies, of which this spirited account by Ben Tarnoff is only the most recent. Out of the hundreds if not thousands of counterfeiters in early America Tarnoff has chosen to recount the tales of three of the most colorful: Owen Sullivan (circa 1720–1756), David Lewis (1788–1820), and Samuel Curtis Upham (1819–1885). By focusing on these three men Tarnoff is able to span three different generations of early American history.

Tarnoff titles his section on Sullivan, which may not have been his real name, “The Confidence Man.” He was an Irish immigrant who came to America as an indentured servant in 1742. Apparently he had the gift of blarney. Although he was an impulsive and hard-drinking hustler always seeking an angle and resentful of anyone who stood in his way, he knew how to charm people and win their confidence. He soon shed his indenture by enlisting in the militia in Maine, which then belonged to the colony of Massachusetts. He became his regiment’s armorer, a position that taught him the metalworking techniques that he would put to good use in engraving plates for forging currency when he returned to Boston at the end of the 1740s.

His career as a counterfeiter did not start well. In August 1749 in Boston a fight with his drunken wife in which she publicly accused him of being a “forty-thousand-pound moneymaker” resulted in his arrest and conviction for counterfeiting. But his talent for encouraging the trust of others, including the authorities, earned him not just minimal punishments for his crimes but the collaboration of partners willing to help him print and distribute fraudulent notes. He soon became, in Tarnoff’s words, “the greatest counterfeiter in colonial America.”

Sullivan picked a momentous year, 1749, to begin his Massachusetts career in counterfeiting. That was the year in which Thomas Hutchinson, scion of a prominent and wealthy Boston family and the speaker of the Massachusetts House of Representatives, sought to retire all of Massachusetts’s paper currency and place the colony’s economy once and for all on the basis of the hard currency of gold and silver. Hutchinson’s efforts were supported by the colony’s elite, including rich merchants involved in overseas trade who had no need for a soft paper currency and well-to-do aristocrats whose wealth was often based on money out on loan and who naturally resented being paid back in depreciated paper currency.

Advertisement

The debate over Hutchinson’s efforts tore Massachusetts’s society apart and produced a spate of writings, both pro and con, on the value of paper money. Tradesmen like the printer Benjamin Franklin obviously realized the importance of paper money, and as early as 1729 Franklin had published a defense of it. If the colonists were to have a medium of exchange in trading with one another, then, given the scarcity of specie, it had to be paper money. But wealthy gentry like Hutchinson knew little or nothing of tradesmen’s concerns and were generally contemptuous of the buying and selling that took place in local markets.

No doubt, all these debates about the value of paper money went over the head of Owen Sullivan. All he wanted to do was counterfeit the paper notes. Following his moneymaking efforts in Boston and Providence, Sullivan in 1752 moved his operations to the remote parts of Dutchess County in New York where he organized the most elaborate counterfeiting scheme the colonies had ever known. He recruited a network of accomplices spanning several colonies and produced and distributed thousands of pounds of fake paper currency. Because Sullivan and his gang operated on the border between New York and Connecticut the authorities had trouble dealing with them. Besides, it was not always clear that people who wanted paper money to carry on their businesses opposed the counterfeiters; they were, after all, producing money that was not all that different from the authentic paper. The more money in circulation the better was often the popular view.

In 1756, after a four-year counterfeiting spree that covered five colonies and made Sullivan a living legend, the authorities finally caught up with him. Although Connecticut had captured him, the colony wanted him executed and thus sent him for trial to New York, which unlike Connecticut had the death penalty for counterfeiting. Sullivan was convicted and hanged. When explaining in his confession after his first arrest why he had become a counterfeiter, Sullivan, in an early expression of the American dream, wrote, “I thought it was an easy Way of getting Money.”

David Lewis, whom Tarnoff calls “The Populist,” practiced his counterfeiting craft in very different circumstances from Owen Sullivan. Sullivan had forged bills of credit printed by a limited number of colonial governments. Lewis, by contrast, had hundreds of different banknotes to choose from. By the early nineteenth century he was working in a counterfeiter’s paradise. With so many notes flying about, who could tell the fraudulent from the real?

The Revolutionary leaders who framed the new federal Constitution in 1787 had not liked paper money any more than the Loyalist Thomas Hutchinson had. Indeed, some of them, including James Madison, had regarded the states’ excessive printing of paper money in the 1780s as one of the principal evils the Constitution was designed to eliminate. Consequently, Article I, Section 10 of the Constitution explicitly prohibited the states from doing what the colonies and the states had habitually done throughout the eighteenth century—emit bills of credit or make anything but gold and silver coin a tender in payment of debts. The framers aimed to do what the British government had been unable to do—stop the outrageous printing of paper notes that had created the repeated bouts of inflation that had so harmed creditors and others on fixed incomes. During the Revolution the states and the Continental Congress had needed to print piles of unbacked notes in order to finance the war effort. But the war was over, and the Founders believed that the country had to get back to a stable specie-supported financial system.

If the constitutional prohibition against the printing of paper money had stuck, the American economy in the early nineteenth century could never have taken off. The states soon got around the restriction by chartering banks that in turn issued the paper notes that entrepreneurs, traders, and businessmen demanded and needed. By 1800 America already had twenty-eight banks. By 1812 there were over ninety, and by 1816 the country had nearly 250—all of them issuing paper notes that circulated as money.

Few of the Founders understood how banks operated. John Adams, no intellectual slouch, believed that “every dollar of a bank bill that is issued beyond the quantity of gold and silver in the vaults represents nothing and is therefore a cheat upon somebody.” Jefferson was no better. He could not comprehend how “legerdemain tricks upon paper can produce as solid wealth as hard labor in the earth. It is vain for common sense to urge that nothing can produce but nothing.”

Advertisement

All the teeming amounts of paper issued by the growing numbers of banks left these hard-money Founders shaking their heads in bewilderment. Adams was so disillusioned by the spread of paper money that in 1819, at the age of eighty-four, he looked back over the decades and belatedly acknowledged the rightness of the hard-money policy of the man he had most hated, Thomas Hutchinson. “I would wake the ghost of Hutchinson,” he admitted, “and give him absolute power over the currency of the United States and every part of it.”

Even Alexander Hamilton, one of the very few leaders who actually understood how banks worked, had not anticipated such a proliferation of state-chartered banks and the paper they issued. Hamilton had created the Bank of the United States in 1791 with the expectation that it would eventually monopolize banking in the country and issue notes that were controlled and carefully secured. Instead, state banks multiplied everywhere, issuing millions of dollars of notes that they could scarcely back up with gold or silver. The worst was probably the Farmers’ Exchange Bank of Gloucester, Rhode Island. It emitted over $600,000 in notes, but in 1809 had only $86.45 in specie to support those notes.

As Tarnoff points out, “the nation’s mushrooming financial sector began to look more and more like a massive counterfeiting enterprise.” David Lewis was just one of many counterfeiters taking advantage of the financial chaos in the country in the early 1800s. He began working on the Canadian border, but soon moved back to his native Pennsylvania. The growing mistrust of notes and the emergence of counterfeit detectors—periodic publications that described in detail both legitimate bank notes and the counterfeits—made the work of counterfeiting more difficult, but they didn’t stop it.

Like Sullivan, Lewis was a charmer, but unlike him he was an educated gentleman, indeed, an Oxford graduate. Imprisoned in Philadelphia’s Walnut Street Jail, he turned informer and earned a governor’s pardon in 1819. He resumed his criminal career, this time as a robber rather than as a counterfeiter, and he developed a kind of Robin Hood reputation as an outlaw with a conscience who punished the avaricious and rewarded the needy. Captured and wounded by a posse in 1820, Lewis was jailed once again, this time in a small Allegheny town. He refused to have his gangrene-ridden arm amputated and died in his cell. But a confession of his life fabricated by a journalist allowed him to live on as a legend.

Samuel Curtis Upham, Tarnoff’s third character, whom he calls “The Patriot,” was very different from the two earlier counterfeiters. With the outbreak of the Civil War, Upham, a Philadelphia shopkeeper and former newspaperman, began printing Confederate notes as souvenirs. But he soon realized that the South’s genuine currency was not all that well engraved and that he could forge it without breaking the law. He began selling his fake Confederate notes at a penny for each $5 bill, later cutting his price in half when faced with competition. He let others, especially Union troops, circulate them in the South. Unlike Sullivan and Lewis, he was never chased by posses, never hid in caves, and was never jailed. But he was a hustler, a fairly successful middle-class one. By the time he was done counterfeiting, he estimated that he had printed about $15 million worth of bogus Confederate bills. He died at age sixty-six, neither by execution nor in a jail cell; he had three decades more of life than Sullivan and Lewis.

If Tarnoff’s book was composed of just the stories of these three colorful characters, it would scarcely warrant much attention, interesting as the stories are. But his book is more than that. It is also, as he says, “the story of a country coming of age—from a patchwork of largely self-governing colonies to a loosely assembled union of states and, finally, to a single nation under firm federal control.” Counterfeiters were important in this story, for “they embodied the nation’s speculative spirit.” It is a story with a message for our own time.

Tarnoff says that he was stimulated to write his book by reading what he calls a “fascinating history of American counterfeiting”—Stephen Mihm’s A Nation of Counterfeiters: Capitalists, Con Men, and the Making of the United States (2007). Without his conversations with Mihm, Tarnoff admits, his own book “wouldn’t have been written.” Although the two writers use different counterfeiters to drive their narratives and focus on somewhat different time periods (Mihm confines his study to the early nineteenth century), the two books have very similar themes. Both assume that counterfeiting was integral to the remarkable development of capitalism in early America. Paper notes were essential to the burgeoning of the American economy, but there were so many of them circulating about that the genuine could not be easily distinguished from the fakes. Whether the notes were authentic or counterfeit, faith was what mattered. Once a note was accepted, once someone put confidence in a bill presented to him, that note, real or bogus, suddenly acquired value.

Confidence, according to both Mihm and Tarnoff, was the engine of economic growth. It was, in Mihm’s words,

the mysterious sentiment that permitted a country poor in specie but rich in promises to create something from nothing…. At its core, capitalism was little more than a confidence game. As long as confidence flourished, even the most far-fetched speculations could get off the ground, wealth would increase, and bank notes—the very pieces of paper that made it all possible—would circulate.

Tarnoff agrees with Mihm. “The American economy,” he says, “rose and fell on a tide of paper credit, fueled by notes that tended to promise more than they could deliver.” As long as everyone had confidence that the paper money had value—whether it was authentic or fraudulent—then it did. But when confidence slipped, mistrust spread throughout the society, setting off a panic. “Americans,” writes Tarnoff, “had a confidence problem: they either had too much of it, taking risks as everything surged, or too little, fleeing the market as everything crumbled.” Since Americans wanted and needed paper money, numerous counterfeiters were more than happy to oblige. “In a country where everyone wanted cash,” writes Tarnoff, “they made it; they extracted wealth from thin air in a nation that had always lived beyond its means.”

Tarnoff’s book is not a typical academic diatribe against American capitalism. He knows that capitalism had its moments of “ruthlessness”; he knows too that there were many risk-taking losers; and he knows that “by the middle of the nineteenth century, the American economy was powered in large part by promises that couldn’t be kept.” Nevertheless, he also knows that all these paper promises were essential to America’s remarkable growth in the early nineteenth century. The periodic panics that plagued the economy were not the fault of a few speculators and financiers; they were the responsibility of a large number of people who wanted to get rich. Following the War of 1812, Tarnoff writes,

American farmers overcame their traditional distrust of banks and took out large loans to develop their land. When the Panic [of 1819] struck, saddling them with intolerable debt, they erupted in anger, blaming everyone but themselves.

A few bankers, then and now, could not by themselves create financial panics. “The surge of inflated wealth,” says Tarnoff, “couldn’t have happened without the complicity of ordinary Americans.”

Tarnoff has a more sophisticated understanding of economic matters than many historians. Andrew Jackson is no hero in his account. In 1832 President Jackson destroyed the Second Bank of the United States without any awareness of the consequences of his action, and the voters rewarded him for it:

They didn’t care that the president was wrong—that the Bank, far from enriching a conspiratorial cabal, had contributed tremendously to the overall health of the nation by stabilizing the currency and curbing bad banking practices.

The Bank of the United States had restrained the excessive issuing of notes by the state banks. Now that that restraint was gone, the state banks were free to issue notes with abandon; and Jackson scarcely comprehended what he had brought about. Like most of the Founders Jackson was committed to hard money; anything else was a cheat. Yet by destroying the Bank of the United States he “had done more to inundate the nation with worthless paper than even the most prolific counterfeiting operation.”

Some wanted to eliminate the banks by making them illegal, but the popular desire for paper money could not be easily thwarted. The Wisconsin legislature was firmly opposed to banks and refused to charter any. So when a Wisconsin marine and fire insurance company that the legislature had incorporated began issuing certificates to its depositors that circulated as money, the angry legislature revoked the company’s corporate charter. The Wisconsin insurance company stayed in business anyway and became one the country’s most important banks. Elsewhere other unincorporated banks sprang up and flourished, even though their notes were illegal. The entrepreneurial demand for credit was irrepressible. “Americans willed a nation into existence on an immense, unfamiliar continent,” writes Tarnoff, “and this act of faith was made possible by a million smaller ones: the confidence that pieces of paper had value.”

The “golden age of American counterfeiting” came to an end during the Civil War. In 1862 the United States made paper money printed by the national government legal tender. This “bold expression of federal sovereignty,” says Tarnoff, “represented nothing less than a revolution in American finance.” The National Currency Act of 1863 followed, and a tax on the notes of state banks put them out of business. The United States had become a new nation. “The war had produced something that seemed unimaginable: a federal monopoly on paper currency…. Never before in American history,” says Tarnoff, “had the power to make paper money been held by a single authority.”

Counterfeiters felt the effects immediately. With a single national currency people no longer had to sift through thousands of different bills trying to distinguish the genuine from the fake. But an agency to detect and arrest counterfeiters was still needed, and in 1865 the Treasury Department created the US Secret Service, which soon severely cut down the number of counterfeiters and counterfeit notes. At the time of the Civil War one third or more of the paper money in circulation had been fraudulent; by the time the Federal Reserve System was established in 1913, counterfeit bills made up less than one thousandth of one percent of the paper money supply.

At present the only American paper money in circulation are Federal Reserve Notes, which as of 2010 are valued at about $900 billion. A majority of these notes are held overseas and supported by nothing but people’s confidence in the United States. As the dollar has become global, so has the counterfeiting of it. But the number of bogus bills remains minuscule. And the Treasury is using new designs to make counterfeiting America’s currency more difficult. Even more threatening to traditional counterfeiting, however, is the eventual disappearance of paper money itself. Electronic money is taking over and will require a new breed of moneymakers.

This Issue

November 10, 2011

Our ‘Broken System’ of Criminal Justice

The Real Deng

In Zuccotti Park